Fascination About Hard Money Georgia

Wiki Article

The Ultimate Guide To Hard Money Georgia

Table of ContentsThe Greatest Guide To Hard Money GeorgiaNot known Incorrect Statements About Hard Money Georgia The Best Strategy To Use For Hard Money GeorgiaHard Money Georgia - An Overview

As you can see, exclusive money finances are incredibly adaptable. It could be argued that personal financings can put both the loan provider and also customer in a sticky situation.

In spite of them requiring to satisfy specific requirements, personal loaning is not as managed as tough cash fundings (in some situations, it's not controlled at all).- Experienced financiers understand the benefits of enhancing their personal cash resources with a difficult money lender.

Hard Money Georgia for Beginners

Over all, they're licensed to lend to actual estate financiers. Perhaps a small disadvantage with a hard cash lender connects to one of the qualities that connects personal and tough money finances guideline.Nevertheless, depending on exactly how you check out it, this is likewise a stamina. It's what makes tough money loan providers the safer alternative of the two for a very first time capitalist as well as the factor that smart investors remain to drop this path. WE LEND PROVIDES A try this VARIETY OF PROGRAMS TO SUIT EVERY TYPE OF RESIDENTIAL REAL ESTATE CAPITALIST.

What Does Hard Money Georgia Do?

It's normally feasible to obtain these types of financings from personal loan providers that do not have the same requirements as typical lenders, these personal loans can be a lot more pricey and also less beneficial for consumers, because the risk is a lot greater. Traditional lenders will certainly take a thorough take a look at your entire economic scenario, including your income, the quantity of financial obligation you owe other loan providers, your credit rating, your my review here other assets (consisting of money reserves) as well as the size of your deposit.

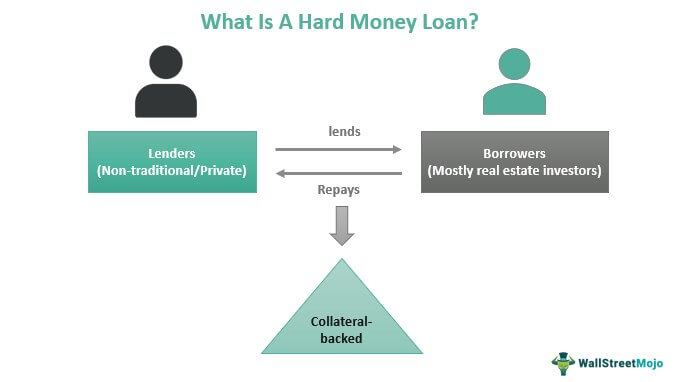

Tough money loans have lots of benefits over organization lendings from financial institutions and also other mainstream lenders. Unlike conventional finances, which are provided by banks or various other economic institutions and also are based primarily on the consumer's creditworthiness and revenue, hard cash finances are provided by exclusive financiers or business and are based largely on the value of the residential or commercial property being used as collateral. Due to the fact that of the danger taken by the loan providers, interest rates are typically greater than the average residence fundings.

Fascination About Hard Money Georgia

Tough money fundings usually have higher rate of interest prices and costs than conventional financings, and have much shorter terms. One great advantage is that the fundings are easier to access; as a result, if you do not fulfillthe qualifications of credentials conventional lender, you can advice easily access quickly loan without finance rigorous undertakingStrenuous A hard money funding is a financing collateralized by a hard asset (in many cases this would be genuine estate).Report this wiki page